The Good

- Financial Gains for Trump: If Trump decides to sell his shares, it could result in a substantial financial gain, potentially adding billions to his net worth. This influx of capital could bolster his resources for his political campaign or other ventures.

- Market Liquidity: The sale of Trump’s shares could increase market liquidity for Trump Media. More shares in circulation might attract new investors or create opportunities for existing shareholders to buy or sell shares more easily.

- Investment Opportunities: If Trump Media performs well after Trump sells his stake, it could be seen as a positive indicator for other investors, potentially leading to increased confidence in the company’s stability and growth prospects.

- Potential Shift in Company Focus: With Trump potentially stepping back from a major stake in Trump Media, the company might have the opportunity to shift its focus or strategy, possibly appealing to a broader audience beyond Trump’s immediate supporter base.

- Market Movement: The potential sale could lead to significant market movement, providing opportunities for traders and investors to capitalise on fluctuations in DJT stock prices, whether through buying, selling, or shorting the stock.

The Bad

- Market Volatility: The sale of such a large stake could cause significant volatility in DJT stock prices. If Trump begins unloading his shares rapidly, it could trigger a sell-off, leading to a sharp decline in the stock’s value.

- Company Instability: Trump’s departure as a majority shareholder might signal instability to investors and the public. Given that much of Trump Media’s brand is tied to Trump himself, his exit could cause uncertainty regarding the company’s future direction and leadership.

- Political Implications: Trump’s sale of his stake might be interpreted as a lack of confidence in the company, which could have political repercussions, especially if he is using the sale to fund his presidential campaign. This could be used against him by his political opponents.

- Potential Legal Scrutiny: The sale of a large block of shares by a figure as controversial as Trump could attract legal and regulatory scrutiny, particularly if there are concerns about insider trading, market manipulation, or conflicts of interest.

- Impact on Truth Social: The departure of Trump from a significant ownership position in Trump Media might impact the user base and engagement on Truth Social, a platform largely associated with his personal brand and political ideology. This could lead to a decline in the platform’s popularity and financial performance.

The Gist

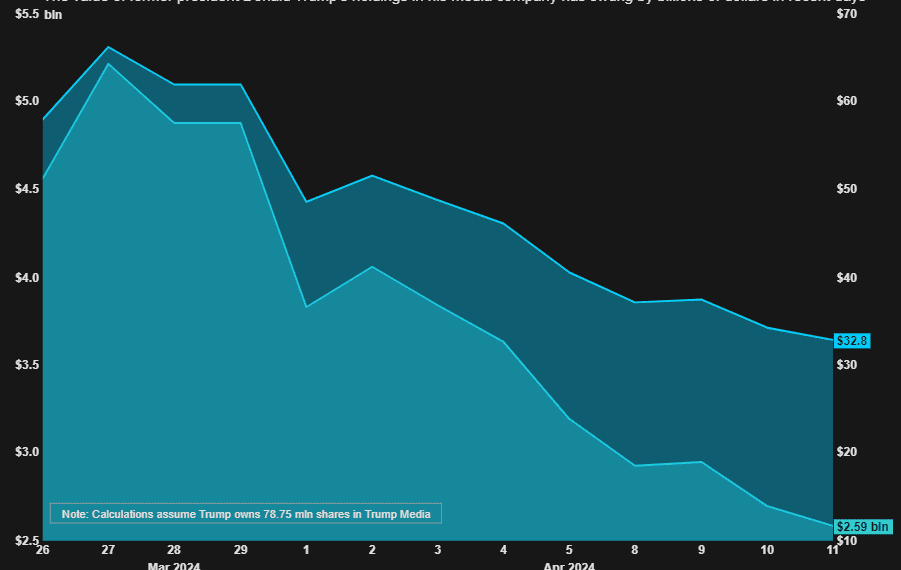

Former President Donald Trump is on the verge of a major financial decision: the sale of his substantial stake in Trump Media, the company that owns the social media platform Truth Social. Trump holds approximately 114.75 million shares, making up nearly 59% of the company, and his stake constitutes a significant portion of his net worth, according to Forbes.

Trump Media recently debuted on the Nasdaq under the ticker DJT, following a lengthy merger with a special purpose acquisition company (SPAC). The potential sale of Trump’s shares raises several questions about the future of the company and its impact on the market. On the one hand, selling his stake could provide Trump with a massive payday and increased market liquidity for DJT. On the other hand, it could lead to significant market volatility, potential instability within Trump Media, and legal scrutiny.

The implications of this sale extend beyond mere financials; they touch on political, legal, and market dynamics, especially given Trump’s ongoing political ambitions. Investors and political analysts alike are closely watching to see how this move might affect Trump’s campaign and the future of Trump Media and Truth Social.

The Take

Former President Donald Trump is approaching a critical juncture in his financial and political career. The imminent ability to sell his stake in Trump Media, the parent company of Truth Social, presents a potentially lucrative opportunity but also carries substantial risks. Trump’s stake in the company amounts to 114.75 million shares, or nearly 59% of Trump Media, making it a significant component of his on-paper net worth, which Forbes estimates to be in the billions.

Trump Media’s journey to its current position has been marked by its recent debut on the Nasdaq stock exchange under the ticker DJT. This milestone was achieved after a protracted merger process with a special purpose acquisition company (SPAC), a route often taken by companies looking to go public with less regulatory scrutiny than traditional initial public offerings (IPOs). The debut of DJT on the Nasdaq was a moment of triumph for Trump and his media venture, but it also marked the beginning of a new chapter, one that could soon see Trump’s departure as a major shareholder.

If Trump chooses to sell his shares, the financial windfall could be enormous. Such a sale would not only bolster his personal wealth but also provide him with significant resources that could be utilised in his ongoing political campaign for the presidency. Given Trump’s history of using his personal fortune to fuel his political ambitions, this potential influx of capital could prove pivotal in his bid to secure the Republican nomination and ultimately win the presidency.

However, the decision to sell also comes with considerable risks. The most immediate concern is the potential for market volatility. Trump’s stake is so large that its sale could flood the market with DJT shares, driving down the price and potentially triggering a broader sell-off. Such volatility could erode the value of the shares, not just for Trump, but for all investors in Trump Media. The market’s reaction to Trump’s sale could be swift and severe, especially if it is perceived as a sign of diminished confidence in the company’s future prospects.

Beyond the financial markets, the sale of Trump’s stake in Trump Media could have profound implications for the company itself. Trump Media is intrinsically linked to Trump’s personal brand and political identity. Truth Social, the company’s flagship platform, was created as a conservative alternative to mainstream social media platforms, catering primarily to Trump’s supporters and those who feel alienated by other platforms’ content moderation policies. If Trump were to step back from his ownership role, it could create uncertainty about the company’s future direction. Investors and users alike might question whether Trump Media can thrive without its namesake at the helm, potentially leading to a decline in user engagement and financial performance.

Moreover, Trump’s potential sale of his shares could attract legal and regulatory scrutiny. The sale of such a significant stake by a high-profile individual like Trump is likely to draw attention from regulators, particularly if there are concerns about insider trading or market manipulation. Given Trump’s ongoing legal battles and the controversy surrounding his previous business dealings, any hint of impropriety in the sale process could lead to further legal challenges, adding to the already complex web of litigation that Trump is navigating.

The political ramifications of the sale cannot be ignored either. As the presumptive Republican nominee for the 2024 presidential election, every move Trump makes is scrutinised by the public and his political opponents. Selling his stake in Trump Media could be portrayed as a lack of confidence in the company or as a cynical attempt to cash in before a potential downturn. Opponents could use this narrative to undermine Trump’s credibility, both as a businessman and as a politician. On the other hand, if the sale is seen as a strategic move to fund his campaign, it could bolster his image as a savvy and resourceful candidate, willing to leverage his assets to secure victory.

In summary, the impending decision by Donald Trump to sell his stake in Trump Media is fraught with both opportunity and risk. The financial rewards could be immense, providing Trump with the resources he needs to fuel his political ambitions. However, the potential for market volatility, company instability, legal scrutiny, and political fallout makes this a high-stakes decision with far-reaching consequences. As the world watches, Trump’s next move will undoubtedly have a significant impact on the future of Trump Media, Truth Social, and his political career.